Senate Vote on ‘Woke’ Investing To Set Stage for First Biden Veto

Senator Tester said Wednesday that he is opposing the rule because ‘it undermines retirement accounts for working Montanans and is wrong for my state.’

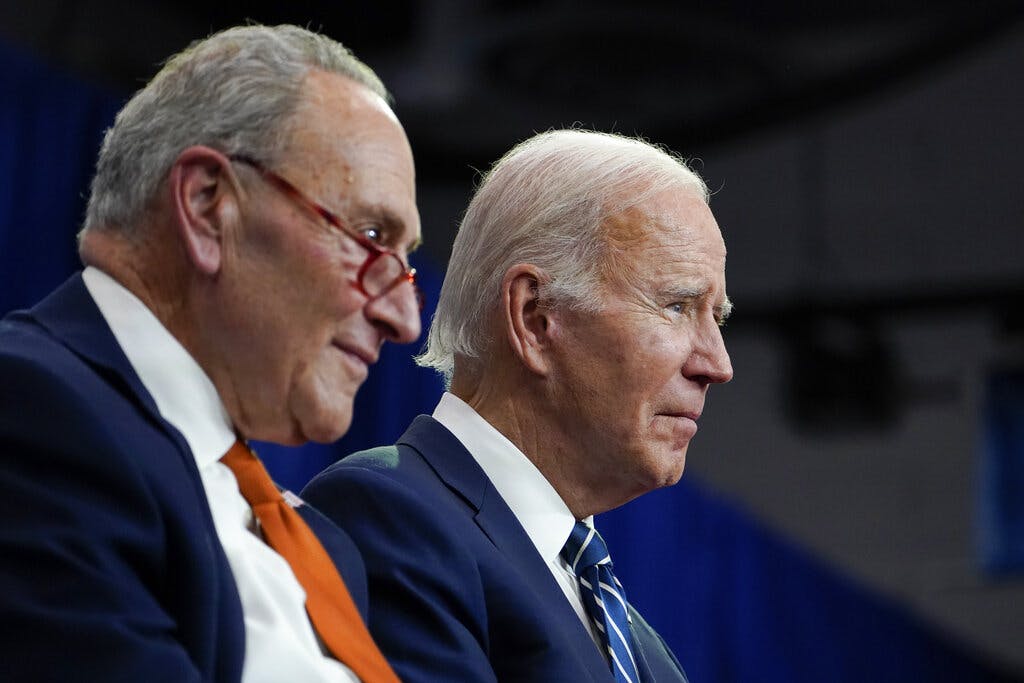

A bipartisan resolution before the U.S. Senate that would quash a retirement investing rule has picked up steam in recent days, setting the stage for the first veto of President Biden’s tenure.

The rule encourages directors of pension and retirement funds to practice so-called Environmental, Social, and Governance investment strategies, also known as ESG. The strategy takes into account companies’ climate investments, treatment of employees, and executive practices.

Two Democratic senators, Joe Manchin and Jon Tester, have signed on to the resolution alongside all 49 of their Republican colleagues, teeing up a vote later this week. “It is irresponsible of the Biden Administration to jeopardize retirement savings for more than 150 million Americans for purely political purposes,” Mr. Manchin said in a statement.

Mr. Tester wrote Wednesday that he is opposing the rule because “it undermines retirement accounts for working Montanans and is wrong for my state.”

Critics have decried the strategy as “woke finance.” The Senate resolution to block the rule was introduced by Senator Braun of Indiana and Senator Scott of Florida. Messrs. Scott and Braun said in a statement that the ESG rule “allows Wall Street fund managers to make choices on behalf of Americans based on their own beliefs and social agenda, not what’s financially sound.”

An accompanying resolution in the House passed on a party-line vote Tuesday. Should the Senate follow suit and Mr. Biden vetoes the measure, as he is widely expected to do, it would be his first veto of congressional action.

Presidential vetoes have grown increasingly rare. Between 2001 and today, only 34 vetoes have been issued. Between 1981 and 2000, that number was 159.

In January, a group of 25 GOP state attorneys general sued the Labor Department and Secretary Martin Walsh to stop the rule from taking effect. They wrote that the rule violated the principle that “fiduciaries act with the sole motive of promoting the financial interests of plan participants.”

The rule was finalized by the Department of Labor last November. Mr. Walsh wrote at the time that the rule encouraged “retirement plan fiduciaries can take into account the potential financial benefits of investing in companies committed to positive environmental, social and governance actions.”

Senator Schumer penned an opinion piece defending the ESG rule. “Nothing in the Labor Department rule imposes a mandate. It simply states that if fiduciaries wish to consider ESG factors—and if their methods are shown to be prudent—they are free to do so,” Mr. Schumer wrote in the Wall Street Journal. “Nothing more, nothing less.”

He added that the vast majority of S&P 500 companies issue their own ESG reports. “I say let the market work. If that naturally leads to consideration of ESG factors, then Republicans should practice what they’ve long preached and get out of the way,” he wrote.

The investment firm Goldman Sachs released a “Sustainability Report” in 2021 detailing its strategy for investing in clean energy and underserved communities. The chairman and CEO of the firm, David Solomon, wrote that “a more sustainable and inclusive economy is not only the right thing to do, it’s the smart thing to do, especially in a world that’s becoming more competitive.”

Other firms disagree. The CEO of the investment giant Vanguard Group, Tim Buckley, recently announced his company would not adopt ESG strategies for its clients.

“Our research indicates that ESG investing does not have any advantage over broad-based investing,” he said in an interview with the Financial Times. “It would be hubris to presume that we know the right strategy for the thousands of companies that Vanguard invests with. We just want to make sure that risks are being appropriately disclosed and that every company is playing by the rules.”