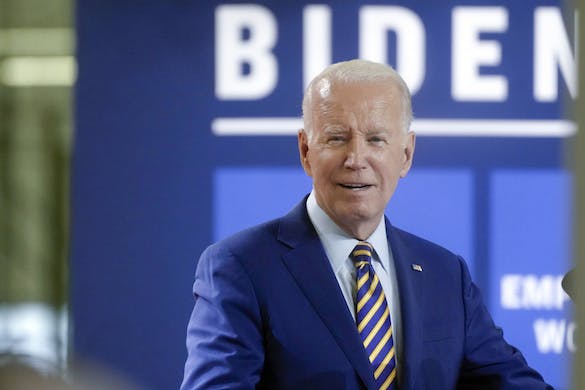

Fiscal Fiasco Emerges in Biden’s Budget Baseline

Congressional estimates going out ten years foresee borrowing from the public soaring to $48 trillion.

There’s a financial story that deserves more attention than it’s getting — and that is the new Congressional budget estimates of President Biden’s baseline over the next ten years. These numbers are a fiscal fiasco.

Government spending and borrowing puts us squarely on the road to bankruptcy. Over the next ten years, Mr. Biden’s spending goes to $10 trillion from $6 trillion. His budget deficit goes to $2.6 trillion from $1.7 trillion.

His borrowing from the public goes — are you ready for this? All the way to $48 trillion, from $26 trillion, which is bad enough. The Congressional Budget Office gives us fifty-year averages with which to compare these numbers.

So, Biden’s spending goes to 24 percent of gross domestic product from 21 percent. His borrowing goes to 116 percent of GDP in 2034 from a 50-year average of 48 percent. And, even with all that government stimulus, the economy is projected to grow by barely 2 percent over the next ten years.

So, while on the one hand the Federal Reserve is trying to restrain inflation, the Biden administration’s huge spending and borrowing is an inflation accelerator.

And, by the way, even while all this government spending and borrowing has temporarily stimulated higher GDP growth, it’s also part and parcel of what I call the affordability crisis, where recent lower inflation does not delete big price hikes over the past three years for essentials like groceries, gasoline, electricity, and so forth.

Working folks have lost nearly 5 percent of their real wages over the past three years, as a result of the lingering effects of Bidenflation. According to a recent TIPP poll, six-in-ten people live paycheck to paycheck. Some 24 percent have zero emergency money in the bank.

Groceries are up 20 percent, gasoline 34 percent, electricity 24 percent. Measured on a pre-pandemic basis, middle-class family incomes went up more than $6,000 during the Trump years, and have fallen roughly $4,000 under Biden.

We’ve had better than expected GDP growth the last couple of quarters, but much of it has come from government spending and borrowing, while the private business economy may actually be in recession.

You read about major layoffs in finance and tech, but you never read about layoffs in government. Private wages are rising a little over 4 percent, government wages rising almost at a 10 percent rate.

The Fed may be trying to hold down the money supply, but with massive government spending it’s going to be hard to restrain inflation on a permanent basis.

And, incidentally, the CBO numbers show it’s a spending problem, not a revenue problem. Over the past fifty years, revenues have averaged a little over 17 percent of GDP. The CBO estimate suggests that’s exactly where revenues will be leveling off in the years ahead.

No, it’s the spending, stupid. Or the borrowing. And it’s got to stop. We need a growth budget that thoroughly reforms spending and the civil service bureaucracy that does the spending.

We need something like the Grace Commission, established forty years ago by President Reagan, that found trillions of dollars of wasteful spending inside the federal government.

We need to keep the Trump tax cuts permanent to maintain supply-side incentives for a private sector business rebound. And, here’s a thought, how about a return to executive budget impoundment?

Something that was taken away fifty years ago during the Watergate scandals, but would be a very useful presidential tool to deregulate spending and red tape.

Watch for former President Trump to talk a lot more about this in the weeks and months ahead. Lord knows we need it.

From Mr. Kudlow’s broadcast on Fox Business Network.