Money Can’t Buy Love

You have the Fed trying to restrain inflation, but the Biden administration’s huge spending and borrowing look to be increasing inflation once again.

President Biden’s heavy-duty federal spending fiasco is forcing interest rates to rise and keeping higher than expected inflation alive. Mr. Biden has poured in almost $6 trillion in new spending. And it looks like he’s planning on at least another $4 trillion in the years ahead, that is according to the new Congressional Budget Office baseline.

Bidenomics would move federal debt held by the public all the way to $48 trillion — from $26 trillion presently, as though that weren’t bad enough — as borrowing could reach 116 percent of the gross domestic product in the years ahead. That’s well over twice the fifty-year average of 48 percent of GDP.

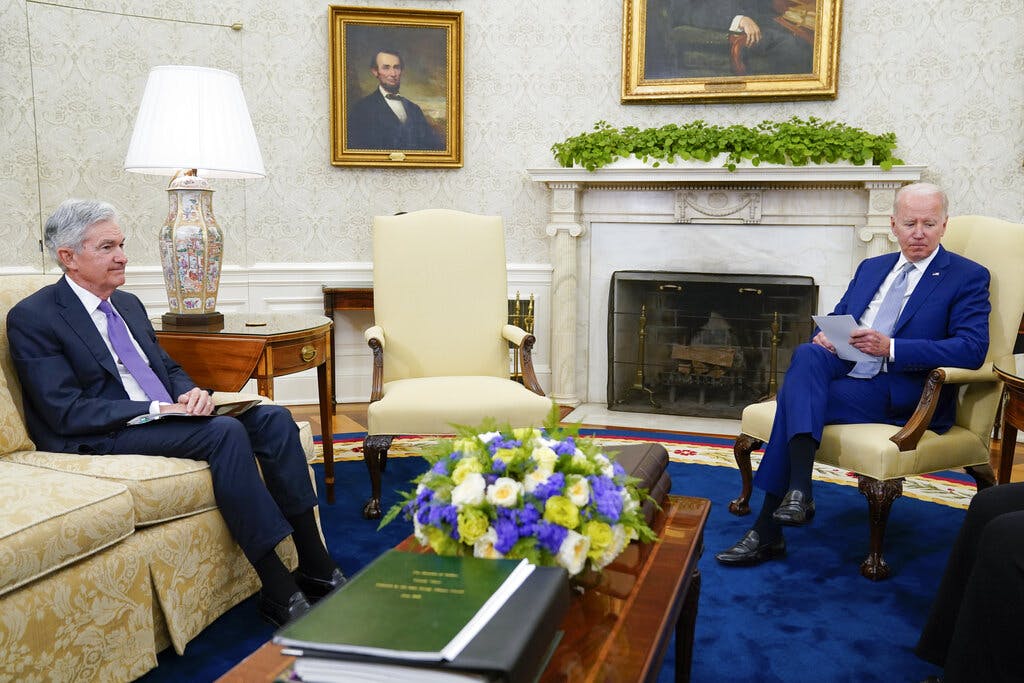

So, you have the Fed trying to restrain inflation on the one hand, but the Biden administration’s huge spending and borrowing on the other hand look to be increasing inflation once again.

Today’s unexpected CPI increase of three-tenths of 1 percent — coming to 3.1 percent over the past year — now, that may not be a one-shot aberration.

Over the past three months, core inflation, that is excluding food and energy, is up 4 percent at an annual rate. Remember, the Fed’s target is 2 percent.

The misguided inflation measure of the Fed chairman, Jay Powell, core services excluding housing, is actually up 6.7 percent annually over the past three months. That’s the fastest rate in nineteen months. Meanwhile services inflation itself is rising 6.4 percent annually over the past three months.

And, just to add to it, the latest ISM survey of manufacturing prices just moved above 50 percent for the first time in ten months. These are not good numbers. They suggest inflation is creeping higher, not lower.

Long-term bond rates spiked all the way to 4.3 percent — up 14 basis points. They’ve been shooting higher since the new year began. All of the Bidens’ government spending gave a temporary boost to GDP, but now they’re paying the inflation piper.

Actually, we are paying the inflation piper. Outsized price hikes continue to pop up all over the economy. Since Mr. Biden took office, groceries are up 20.8 percent. Energy up 29 percent. The Consumer Price Index itself is up 18 percent.

Want more? Eggs up 37 percent. Gasoline up 33 percent. Baby food up 29 percent. Electricity up 28 percent. And I could go on and on. With all these price hikes for live-a-day essentials, real average weekly earnings for typical families have fallen by 4.9 percent under Bidenomics.

That key measure under Trump rose $6,000 for families, or roughly 9 percent. Minus 4.9 percent, plus 9 percent. Now, that’s a contrast. So, folks, the moral of the story is you can’t spend your way into prosperity.

All of a sudden, prices are going up again, interest rates are going up again, and the Biden-created affordability crisis is worsening. If it weren’t an election year, the Federal Reserve should probably be tightening their money and interest rate targets.

Certainly not lowering them, that’s for sure. Meanwhile, Mr. Biden will never learn that money can’t buy you love.

From Mr. Kudlow’s broadcast on Fox Business Network.